retroactive capital gains tax history

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. This change is significant because it would be the first retroactive capital gains increase in US federal tax history.

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

A Retroactive Tax Increase Biden wants to tax capital gains you made even before a bill passes.

. Financial advisers say Bidens retroactive capital-gains tax hike gives them wiggle room Last Updated. Rather than only having to pay taxes on future unrealized capital gains Wydens proposal would require affected taxpayers to pay taxes on allaccumulated unrealized gains up to that point. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of.

But prior to such legislative change could be subject to a higher capital gains rate. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after April 2021. The Green Books proposed change to long-term capital gains is retroactive.

A historical review suggests that any tax legislation enacted in 2021 could have retroactive effect to transactions. The Democrats proposed tax deduction for the rich puts the Vermont socialist and low. Retroactive Tax Increases and The Constitution This lecture was held at The Heritage Foundation on April 15 1998.

Retroactive tax provisions in 1969 1987 and 1993 withstood constitutional challenges in part because they were designed to create more taxpayer equity and to eliminate loopholes. May 28 2021 at 359 pm. The failure of Congress to act before the end of 2009 means that there are currently no Federal estate or GST taxes in effect for 2010.

Federal tax history and would have potentially far-reaching consequences. The retroactive aspect of the tax hike is a tacit admission that such a large tax hike is likely to change investor behavior as taxpayers seek to avoid paying such an elevated rate. 1st Retroactive Capital Gains Increase in US.

In 1969 during Richard Nixons administration Congress passed the Tax Reform Act of 1969 which raised certain income tax rates with at least twenty retroactive effective dates. Financial advisers say Bidens retroactive capital-gains tax hike gives them wiggle room Last Updated. May 31 2021 at 1250 pm.

Capital gains on investments can result in triple-taxation. I looked in a number of books for a good joke about taxes but I couldnt find any. Retroactive Changes to Long-Term Capital Gains.

Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have been greater. The Likelihood and Enforceability of a Retroactive Tax Asset Protection Society. Completed at any time in 2021.

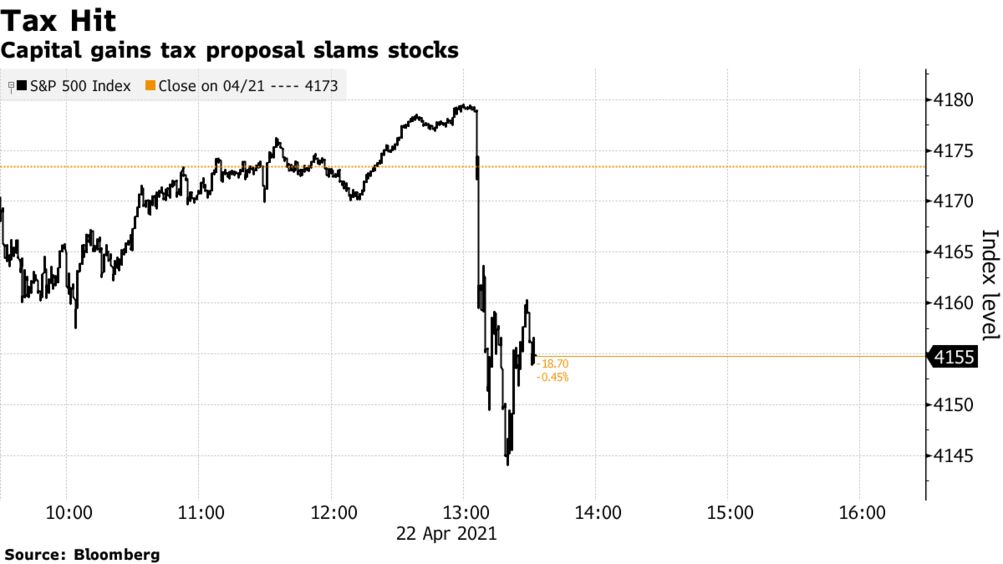

History isnt a great guide because all recent changes in capital gains have been to lower them and in those cases you would have wanted to be stimulative and make it. Critics of the plan say it will hurt investment and economic growth by penalizing gains. Biden calls for his capital gains tax proposal to be retroactive.

In recent years such retroactive rate changes have occurred as late into the year. History Set forth on page 62 of the Green Book tax is the proposal we have all heard about the increase in the capital gains tax rate that will raise the top rate for households earning more than 1 million to 434 a number that includes an existing 38 surtax to help pay for the Affordable Care Act from the current 238. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the.

At this point though its looking like the earliest the Biden tax plan will be passed is. Although several bills have been introduced to address the repeal of the estate and generation. The Green Books proposed long-term capital gains increase would be the first retroactive capital gains increase in US.

In 1969 during Richard Nixons administration Congress passed the Tax Reform Act of 1969 which raised certain income tax rates with at least twenty retroactive effective dates. A report by the Tax Policy Center shows that capital gains realizations rose by 60 percent in 1986 before the new tax rate of 28 percent was due to come into effect in 1987 from the previous 20 percent. A historical review of changes to the capital gains tax rate in the United States suggest that.

Similarly widespread exits jumped 40 percent. These changes would relate back to April 28 or May 28 2021. This resulted in a 60 increase in the capital.

When taxes go up investors naturally rush to realize their gains at the lower tax bracket before the hike takes effect. While the most significant recent capital gains rate change provided by the JGTRRA was largely prospective it was still in part retroactive and included a complicated transition rule that.

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Good And Bad News From The Aba Futures Report Perspective Decade Century Aba Bad News

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Managing Tax Rate Uncertainty Russell Investments

Wall Street On Tax Plan It Will Incentivize Selling This Year Bloomberg

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

How To Help Your Real Estate Investor Clients Structure Their Businesses Accounting Today In 2021 Real Estate Investor Real Estate Investors

Pdf Discretionary Tax Changes And The Macroeconomy New Narrative Evidence From The United Kingdom

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Pdf Discretionary Tax Changes And The Macroeconomy New Narrative Evidence From The United Kingdom

Macroeconomic Effects Of Tax Rate And Base Changes Evidence From Fiscal Consolidations In Imf Working Papers Volume 2018 Issue 220 2018